- Attain Wealth. protect lEgacies.

Investment Management

We provide uniquely crafted, personalized financial management solutions that empower our clients to attain their financial goals, build their wealth, and protect their legacies.

As independent advisors we have discretion to choose among the entire investment universe to find the ideal investments for your unique circumstances.

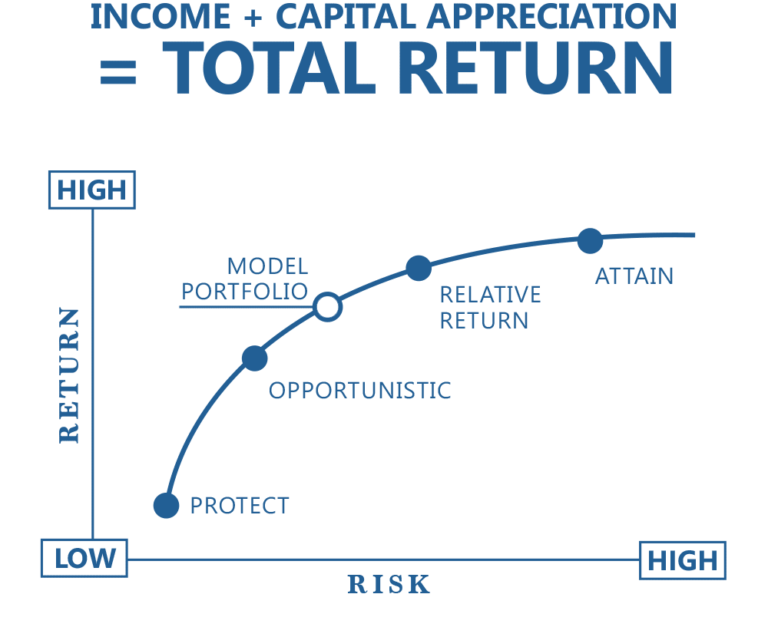

We achieve success through our two-fold investment strategy:

Seeking total return (capital appreciation and income generation) by staying invested over the long term

Customizing portfolios according to your risk tolerance and unique situation

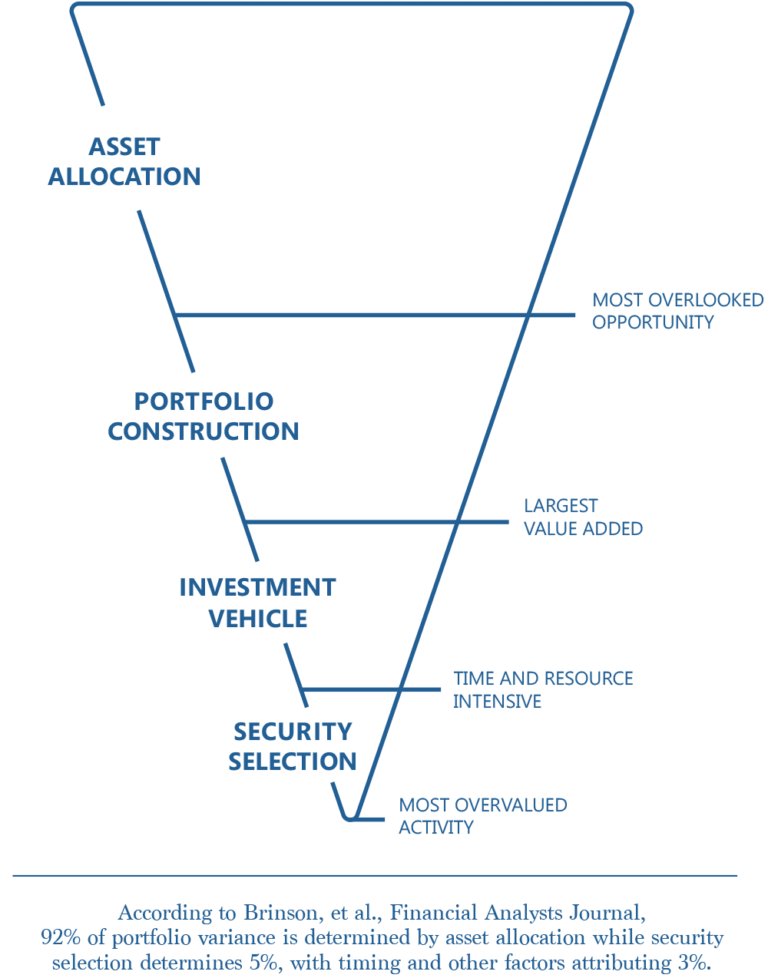

Maximizing total return through appropriate asset allocation

- We first seek to understand your needs, including your lifestyle, risk tolerance, long-term goals, and income requirements, and then build customized investment strategies based on your entire financial picture.

- Our solutions are crafted to withstand the test of time.

- We believe proper asset allocation and remaining invested are core factors in long-term investment performance.

- We believe in regular portfolio rebalancing to stay true to our asset allocation decisions and maximize long-term returns.

Customizing Investment Portfolios Using Model Portfolio Groups

- Our core strategy emphasizes total return via capital appreciation and investment income.

- Custom designed portfolios use our model groups to form a balanced and methodical approach to investing.

- We utilize asset managers who have a long-term track record of success, and we perform independent research to validate our decisions.

Custom Designed Portfolios use these model groups to form a balanced and methodical approach to investing.

10 Things To Consider When Planning To Transition To Retirement

In this free report, we’ll explain what you can do to prepare for a successful transition to your golden years.

We’ll add you to our newsletter for other useful content. We promise not to share your information or send spam.