Small Business Retirement Planning

Are you a business owner looking to:

- Boost your retirement savings?

- Reduce your personal and business tax liability?

- Take care of your employees, foster loyalty, and provide competitive benefits?

At AP Wealth, we understand the challenges you face as a business owner. We recognize that your business and personal finances can be tightly meshed. We will partner with you to create a comprehensive plan that factors in everything you’re facing, and everything you’re trying to build, preserve, and pass on to your successors and heirs.

A Small Business Retirement Plan is a great tax-advantaged way for employers to bolster their own retirement while offering a key benefit to their employees. Running your business is a full-time job. By hiring an advisory team with specialized knowledge in this area, you’ll be able to spend less time administering your plan, and more time doing what you do best – growing your business!

Benefits of having a Small Business Retirement Plan

Wealth Building for Owners

Tax-Deductible Contributions

Increased Employee Retention

Enhanced Employee Satisfaction

Small Business Retirement Plan Options

401(k) Plans

A 401(k) plan is a company-sponsored retirement account to which employees can contribute. Employers may also make matching contributions. There are lots of ways to structure a 401(k) plan. We will help you navigate all the options such as Safe Harbor provision, Roth, Traditional, discretionary and non-discretionary matching, vesting schedules, loan provisions, in-service withdrawal provisions, and more. We help business owners review existing 401(k) plans for ways to optimize an existing plan, or to help owners implement a new plan.

Profit-Sharing Plans

Cash Balance Plans/Defined Benefit Plans

SIMPLE IRA Plans (Savings Incentive Match Plans for Employees)

SEP Plans (Simplified Employee Pension)

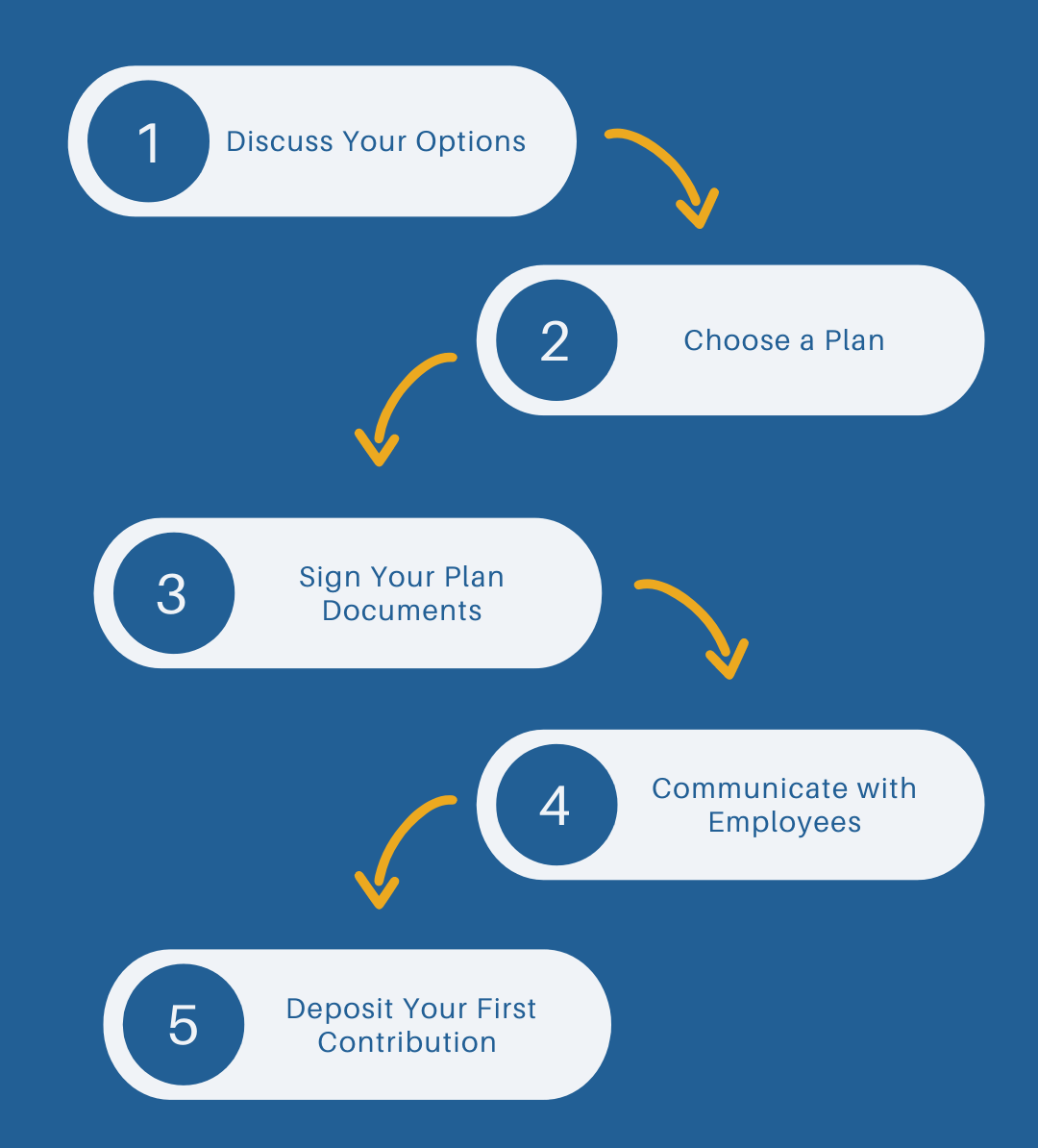

Our Process

401k Plan Fiduciary

Many small business owners aren’t aware of their duties as a 401(k) plan sponsor. Having an advisory team that specializes in working with small business retirement plans can provide tremendous value – including more than just investment selection and monitoring. By working with AP Wealth Management, you will have

- A dedicated point of contact

- Access to specialized expertise and connections

- Ongoing employee education and financial guidance

401k Plan Communication

Compensation

AP Wealth Management is compensated based on a percentage of assets under management (AUM) with a minimum annual fee. As an independent, fee-only firm, we do not receive commissions for the sale of financial products and we do not receive any payments from the third-party plan administrator. The third-party plan administrator is separately compensated based on a fee per participant and a percentage of assets under management with a minimum annual fee.