As the third quarter comes to a close, the market is hovering at its lows for 2022. If you are following the news, you know the Federal Reserve has raised short-term interest rates significantly this year in an effort to bring inflation back down to its target of 2%. Higher interest rates slow the economy, resulting in lower corporate earnings and lower stock prices. We realize market downturns can be very unsettling and losses difficult to endure. We also know from history that this downturn will end and the markets will move higher. Our clients’ portfolios are built for the long-term and they will withstand this downturn. We’ve seen this cycle before and are confident it will reverse itself when inflation drops and the Federal Reserve cuts rates to stimulate the economy. Below are the takeaways from our June market update that we recommend you review to keep top of mind during this volatility.

1. Media and News

Even when markets are doing well the doom and gloom stories are prevalent because that is what get eyeballs to read them. Financial articles are often focused on negative information impacting very short time periods. Reading lots of doom and gloom articles is not good for your overall health. We encourage clients to stay informed, but we also advise you to maintain a healthy long-term perspective.

2. AP Wealth’s Long-term Perspective

It is easy to forget where we have been. Ten years ago, the S&P 500 was around 1,300. This week the S&P 500 is around 3,650. That is a 180% return over the last 10 years and we are currently in the middle of a 20% downturn today. A big part of that is the returns we experienced in 2019 (28.88%), 2020 (16.26%), and 2021 (26.89%). That is a 72% return over three years. Even with the downturn, the S&P 500 is up 50% over the last three years for an average annual return of 16%. It is not fun to see account values go down, but over time diversified portfolios do very well.

3. Stay the Course

Asset allocation is the most important piece to your long-term success. We have had some great conversations with clients over the last few weeks. All our clients’ portfolios have a customized asset allocation based on their goals, time horizons, risk tolerance, and overall financial situation. Please do not hesitate to call us if you get nervous or feel anxious along the way. We are happy to walk you through your individual plan to help you stay the course.

4. Market Timing

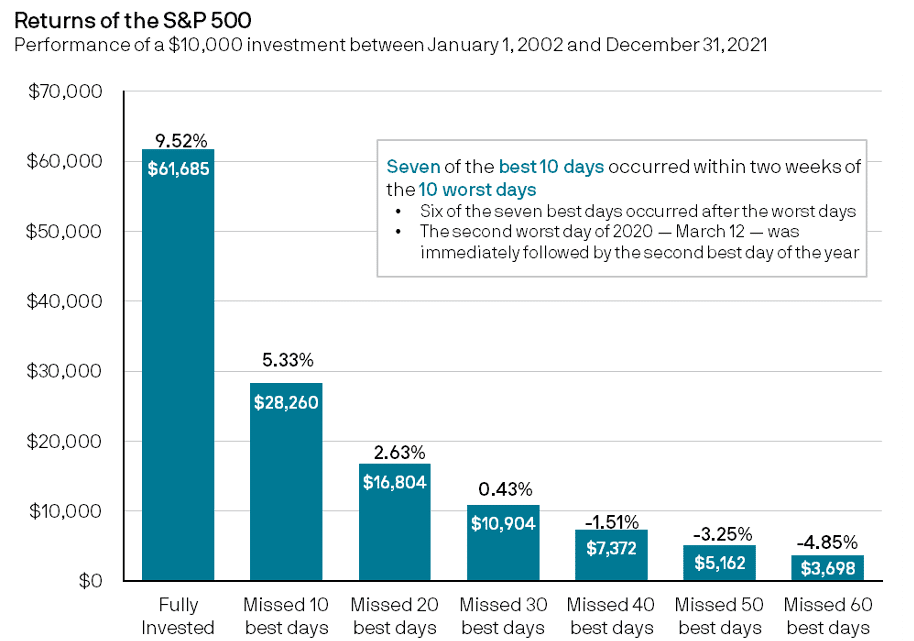

We are not believers in market timing. It is very common for the best market days of the year to follow the worst days. The chart below demonstrates the importance of staying invested.

5. Fed Hiking Interest Rates

This week the federal reserve increased the fed funds rate by .75%. That is the largest monthly interest rate hike since 1994. The goal of interest rate hikes is to cool down the economy and reduce inflation. For stocks, rate hikes increase uncertainty which increases volatility. For bonds, rate hikes increase yields. That is the silver lining here, higher interest rates mean you can earn more interest on your cash and fixed income holdings. A 2-year treasury bond now pays over 4% interest. AP Wealth will help position client portfolios to take advantage of this.

6. Tax Planning

If you have a taxable account, you may have holdings with unrealized losses. As we rebalance, we will consider harvesting those losses. This accomplishes two things. First, we can maintain your asset allocation, and second, we can use the realized loss to offset future realized gains and save you taxes.

7. Investment Opportunity

AP Wealth views downturns as an opportunity to rebalance and invest excess cash clients have. When downturns like this happen, you can buy stocks at low prices. If you have additional cash that is not earmarked for a short-term goal, please let us know.

8. Helping Others

AP Wealth is here to help families make good financial decisions. If you have family or friends that need support or feedback on their financial situation during this downturn, please share the AP Wealth name with them.

If you have any questions about the market, our trusted news sources, or anything else, please feel free to call us at (706) 364-4281. We’d be happy to speak with you.

________________________________________________

Clayton joined AP Wealth Management as a fee-only financial planner in 2019 bringing with him over a decade of experience working as a financial planner and investment advisor. Clayton is passionate about the commission-free business model that allows him to sit on the same side of the table as the client, serving as a fiduciary for them. AP Wealth Management is a fee-only fiduciary firm in Augusta, GA, specializing in retirement and financial planning for local residents.

- Clayton Quamme